Swarovski has offered to partner with Yellow River to supply 500-600 million RMB of man made diamond products per month, while Yellow River Cyclone, a leading upstream player in the man made diamond industry, has a monthly production value of only 50 million as of mid-21 years.

Swarovski's current demand for one month is equivalent to the output value of Yellow River Cyclone for a whole year, so you can imagine that the demand for lab diamond in the end market has already started to explode, passing from downstream demand to upstream production capacity, resulting in an oversupply. As much as Yellow River Cyclone wanted such a large order, it said it had limited capacity and reluctantly declined to cooperate. The rapid change in demand has caught the market all a little off guard.

An emerging gemstone market with low penetration

When we think of diamonds, the adjectives that come to mind are premium, expensive, rare, solid and so on. Over the past hundred years, it has been universally accepted by the population for its use as decoration as a wedding, exploding from a common stone into an unimaginable market demand.

The market for natural diamonds has developed to a point where it is now very well established.

According to De beers data, global diamond jewellery sales reached US$76 billion in 2018, with an average compound growth rate of 2.82% over the period 2009-2018, growth has been very little.

The jewellery giants also preserve the value of natural diamonds by having a high monopoly on the mining rights of natural diamond deposits and controlling the overall circulation of natural diamonds. in 2016, De Beers, Elsa, Dominion, Lucara, RZM Murowa, Petra and Rio Tinto formed the Natural Diamond Alliance, which together accounts for 75% of total global natural diamond production.

And so the jewellery giants are just plain and simple making money. Because, at least for now, natural diamonds are still scarce. The world's proven reserves of natural diamonds are 2.5 billion carats, or roughly 500 tonnes. Of this, 80% is for industrial use and only 20% is of gem-quality standard. The basic industry is already in the hands of a coalition of giants.

But there is a point of knowledge that the earth's natural diamond reserves are not actually scarce, due to the high temperature and pressure environment, diamonds are mostly present in the formation with the mantle layer and in the past a small portion was brought out due to volcanic eruptions. A joint study by the Massachusetts Institute of Technology and other universities has tentatively estimated that there are 10 trillion tons of diamonds deep in the mantle. There is just not the technological power to dig that deep yet.

Interestingly, we now have the technology to artificially man made diamond by simulating the environment required for diamond formation.

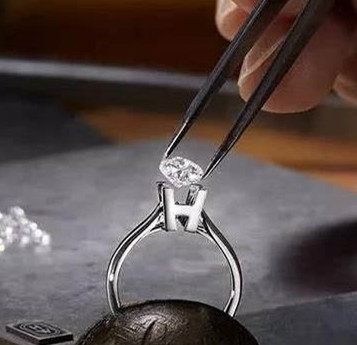

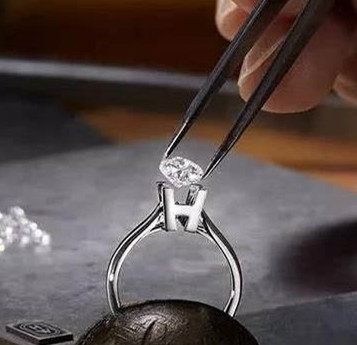

Lab diamond are crystals diamond that have been synthesised using scientific methods to simulate the crystallisation conditions and growth environment of natural diamonds. In terms of product properties, both lab diamond and natural diamonds are pure carbon crystals with identical physical, chemical and optical properties, comparable to natural diamonds in terms of transparency, refractive index and dispersion, and identical to natural diamonds in terms of brilliance, lustre, fire and sparkle, etc. Both lab diamond and natural mineral diamonds are genuine diamonds, different in nature from imitation diamonds such as moissanite (carbon silica) and rhinestones (cubic zirconia). ) and rhinestones (cubic zirconia).

The global man made diamond industry has seen explosive growth in the last two years in particular. India is the global diamond processing hub, according to the "2020~2021 Global Diamond Industry Report" released by Bain Consulting, India reduced its net import of rough diamonds by 23% in 2020 under the impact of the epidemic, but still occupies 95% of the rough diamond processing market. So we can look at India's import and export data to get a good picture of the latest demand for lab diamond.

India's rough diamond imports for the years 015-2020 (current year data from April of that year to March of the following year) are US$0.14/1.15/2.41/1.36/3.44/6.15 billion respectively, representing a CAGR of 112%.

India's exports of rough diamonds will be US$0.64/1.31/2.16/2.25/4.21/7.04 billion from 2015-2020, growing at a CAGR of 62%.

From January to April 2021, India cultivated rough diamond imports/loose diamond exports of US$329/308 million, a significant increase of 293.94%/168.73% year-on-year, compared to 432.33%/220.47% year-on-year in 2019, taking into account the greater impact of the epidemic in 2020.

With such explosive growth, the global penetration of lab diamond in 2020 is only around 6.31% or so.

Why are lab diamond on the rise?

According to Bain Consulting, the global production scale of rough lab diamond is expected to reach 10-17 million carats in 2030, with an average annual growth rate expected to remain at 15%-20%. If we consider the 2/3 loss rate, the global production scale of rough lab diamond is expected to reach 30-51 million carats in 2030.

For the rise of lab diamond, there are probably several reasons.

1. The man made diamond certification system is gradually improving

According to the MVI survey, 56% of consumers attach great importance to the certification grade of lab diamond, especially for larger carats.

The smart thing about the market is that it separates natural diamonds and lab diamond into two markets, so that both markets are likely to survive well. If they were confused, the system would be confusing and diamonds could fall straight down the pecking order.

Separating the markets, positioning them differently and establishing order, is a very crucial role.

In 2018, international and domestic diamond appraisal bodies have launched appraisal certificates for lab diamond, which on the one hand recognise the special status of lab diamond in the jewellery sector, provide credibility guarantees and give lab diamond a definite market identity; on the other hand, solve the problem of confusing standards for lab diamond and provide a reference basis for the subsequent circulation of the value of lab diamond.GSI released the The IGI issued a grading certificate for lab diamond in 2005 and adopted the 4C grading standard for natural diamonds, and the GIA will start to provide a 4C grading report for lab diamond in 2019. The NGTC, a domestic testing body, will issue a grading certificate for lab diamond in March 2021, with the same detailed grading as for natural diamonds.

2. Maturity of the technology

Lab diamond are already at a good level in terms of 4C standards, and advances in the preparation process have contributed to an overall improvement in the weight, clarity and colour of the product, with quality already meeting consumer demand. In terms of individual standards, lab diamond can reach a maximum of 10 carats or more, and 1-2 carats can already be produced in stable quantities; colour can achieve D/E/F grade, clarity can reach VVS/VS grade, and the cut can reach the same best excellent grade as the natural diamond process.

3、The product has certain advantages and creates a new demand

Lab diamond are not only real diamonds, but they can be sold at around 30% to 50% of the price of natural diamond jewellery of the same grade, and can be synthesised into coloured diamonds such as blue and pink, which are rare in nature. This is a perfect fit for the new generation of consumers who are looking for a personalised way to enjoy their luxury. With future technological iterations, it is expected that there will be a lot of room for price reductions.

And to be honest, it's not that convenient to wear a few tens of thousands or hundreds of thousands of diamonds on your body, and there are really not many people who take them out and wear them. In particular, the mind is not as smooth, fearing that one might accidentally lose it or even be targeted by thieves. If you wear a man made diamond, the price is not that high and there is no pressure on your mind to use it for decoration.

In addition, natural diamonds are said to retain their value, but when it comes to reselling them second-hand, there is basically no market for them, unless they are discounted enough for others to buy them first-hand. Basically, after buying, in addition to the wealthy among the sought-after large carat diamonds, otherwise most of them are rotten in the hands, really a forever.

4, the jewellery giants continue to join

The market's wind shift was probably marked in May 2018, when De Beers, the world's largest diamond producer, said it would never get involved in "synthetic diamonds", officially announced the launch of the man made diamond brand Lightbox.

Then this year Pandora announced that it was abandoning all natural diamonds.

As the global jewellery giants continue to nurture and educate the market, consumer awareness and acceptance of lab diamond has increased significantly.

Upstream opportunities

The man made diamond industry chain is relatively simple, with upstream rough diamond production, midstream processing and downstream retailing.

The upstream rough and downstream end-consumer margins are high, at around 60%, while the midstream margins are low, at around 10%, with 95% of the processing in India.

Upstream, the total global production of rough lab diamond in 2020 is in the range of 6-7 million carats, with China's rough man made diamond production of about 3 million carats, accounting for half of the global production capacity. This is followed by India and the United States, with 1.5 million carats and 1 million carats respectively, accounting for a combined share of over 30%.

Downstream, 80% of global man made diamond consumption is in the US, with China being the second largest consumer market. In terms of consumption structure, according to Bain & Company's Global Diamond Industry Research Report 2020-2021, the US and China account for approximately 80%/10% of the global man made diamond consumption market. 2018-19 world demand for diamond jewellery is relatively stable, with the exception of the US, where demand increased by US$2 billion, while the rest of the market remained stable.

There is a higher acceptance of lab diamond among younger consumers in the European and US markets. According to the MVEye survey, nearly 80% of young consumers in the US are aware of the existence of lab diamond. Europe's understanding and acceptance of lab diamond is surpassing that of the U.S. 77% of European consumers are aware of the existence of lab diamond; 25% of European consumers believe that lab diamond are the same as natural diamonds and are more environmentally friendly and less expensive; only 8% of European consumers believe that natural diamonds are rarer and hold their value better.

T herefore, in the short term, there are more opportunities in the upstream of the country, and in the long term, with market education in place, the domestic downstream consumer market still has a lot of potential.

The current upstream man made diamonds mainly follows two technical routes, high temperature and high pressure (HTHP) and chemical vapour deposition (CVD).

High Temperature High Pressure (HTHP) method: HTHP technology completely simulates the growth process of natural diamonds by reproducing the reaction of the elemental layers of carbon on the ground and converting graphite into diamonds.

Chemical Vapour Deposition (CVD): Typically, carbon containing gases are dissociated under the action of high temperature plasma and carbon atoms are deposited on the substrate to form a diamond film.

Both HPHT and CVD have their advantages, with HTHP being more efficient and better coloured and CVD being better in terms of purity. The HPHT method is now more mature and can already supply 1-2 carats in bulk to the mainstream loose stone consumer market, with the drawback of purity problems caused by metal catalysts, particularly in large grain diamonds; the CVD method produces diamonds with high clarity and high weight, with the drawback of long growth cycles and unstable colour.

If we take the current situation of rapidly rising demand, the HTHP method, which can be cultivated quickly, is more suitable for the current situation of the industry.

While 90% of the current HPHT production capacity is in China, the CVD method capacity is mainly concentrated in the USA, Europe, the Middle East, India and Singapore.

From the perspective of specific enterprises, Chinese man made diamond producers mainly include Yellow River Cyclone, Zhongnan Diamond (a subsidiary of Zhongbei Red Arrow), Ningbo Chaoran and Shanghai Zhangshi, among which Yellow River Cyclone and Zhongbei Red Arrow are listed companies, mainly using the HPHT method to produce lab diamond and occupying a major share of the domestic market, with Zhongbei Red Arrow having reserves of the CVD method. Ningbo Chaoran and Shanghai Zhangshi are also producing lab diamond using the CVD method and are in a period of rapid development, while Yu Diamond, Power Diamond and Guoji Jingong also have some production capacity.

In addition, Indian man made diamond producers include Creative Technoogies, New Diamond Era, Diamond Eleents and ALTR, while US man made diamond companies include Diamond Foundry, Lightbox/Element Six (Lightbox is a De Beers man made diamond brand and ElementSix is a De Beers man made diamond brand). The main US cultivation companies are Diamond Foundry, Lightbox/Element Six (Lightbox is the De Beers cultivation brand and ElementSix is the cultivation diamond production subsidiary of De Beers) and Washington Diamonds.

There are certain financial and technical barriers to the cultivation industry, with the larger the carat size of the lab diamond, the higher the barriers, which is beneficial to the leaders. However, it is a pity that Yellow River Cyclone, as the leading company, has historical financial legacy problems, which makes it difficult to release performance in the short term, while the cultivation diamond business of China Bing Red Arrow accounts for a small percentage, diluting part of the growth. In addition to this, immediately listed power diamond can also be concerned.