Recently, 'lab diamonds' have become popular. Some cultivated diamond brands are attracting the attention of the capital market, such as LightMark, which closed a Pre-A financing round for RMB 130 million. On the supply side, upstream producers of lab diamonds are seeing a surge in performance, rapid expansion and full production and sales. On the consumer side, lab diamonds are also increasingly accepted by young consumers.

However, overall, lab diamonds are still at an early stage of development in China and most consumers are at the "low awareness" stage of "never heard of" and "don't know". Discussions on round lab diamond are mostly popular, focusing on topics such as "are lab diamonds worth buying" and "how to buy lab diamonds for beginners". Next, I would like to answer a few key questions about lab diamonds in an attempt to analyse how much room there is for lab diamonds to grow in the future. Are lab diamonds so cheap that they are "real"?

CVD lab diamond were first used for industrial purposes, and since the 20th century the demand for diamonds has increased due to extractive drilling, precision machining and other industries. At that time, man-made diamonds were also known as the pearl of industry and were mainly used to make industrial cutting tools due to their hardness, but they were often not processed into jewellery due to their poor aesthetics and purity.

It was not until 2003 that, thanks to a technological breakthrough, the laboratory was able to produce "jewellery grade" diamonds, from which it had the opportunity to enter the jewellery market. In 2015, Zhongnan Diamonds has mastered the technology of synthesising 20-50 carat lab diamonds and has been able to mass produce them, laying the foundation for further expansion of the cultivated diamond consumer market.

To the naked eye, lab diamonds are virtually indistinguishable from man made diamonds in appearance, as they are cultivated by simulating the environment in which natural diamonds are produced. In contrast, zircon (cubic zirconia), moissanite (silicon carbide), white sapphire, rutile, spinel, etc. differ significantly from diamonds in their physical and chemical composition and are "pseudo" diamonds.

Cultivated and natural diamonds are graded using the same 4C's, i.e. the Gemological Institute of America (GIA) pioneered the "4C's" and the International Diamond Grading System, which classifies diamonds in four dimensions: Colour, Clarity, Cut and Carat. The diamonds are certified on four dimensions: Colour, Clarity, Cut and Carat.

Lab diamonds and natural diamonds also share the middle and lower reaches of the diamond chain. Both natural and lab diamonds are part of the upstream 'raw material', which has to be polished and processed in the midstream before being sold as jewellery in the C-side or as industrial diamonds in the B-side.

In addition, there are three main advantages of lab diamonds over natural diamonds.

One is the price, with its loose diamonds being only 3-5% off the retail price of natural diamonds. For example, at the same level, 20,000 may only buy a 20 cent natural diamond ring, but you can buy a 1 carat cultivated diamond ring; secondly, they can be mass produced, compared to the scarce natural diamonds, especially fancy coloured diamonds, but synthetic diamond can be mass produced; thirdly, they are environmentally friendly enough, compared to mining, which is not green enough, not sustainable and not in line with the ESG philosophy.

However, lab diamonds, which are also "real" diamonds, are cheaper and more environmentally friendly than natural diamonds, so will the price of natural diamonds fall all the way?

"Will the price of 'natural diamonds' fall?

The emergence of lab diamonds is considered by many to be a powerful tool to break the price monopoly of diamonds.

Natural diamonds are actually composed of the most common elements of carbon and are also natural crystals with a cubic structure. With strong refraction, high dispersion, transparency and purity, diamonds are able to produce wonderfully sparkling light, thus circulating on the market as gemstones as early as the fourth century AD, and by the 1400s, diamonds had become a fashion accessory for the European elite, as well as a collector's jewel.

Deep underground, natural diamonds are formed under harsh conditions, usually over hundreds of millions of years at a pressure of 4.5-6.0 Gpa and temperatures of 1100-1500°C, at a depth of around 100 miles below the surface. And at the time, there were very few known natural diamonds and they were very rare indeed.

It was not until the late 1800s that the first large diamond mines in South Africa were excavated and tons of diamonds were unearthed. De Beers, today the world's largest and oldest diamond mining company, took control of the pricing of natural diamonds by monopolising the upstream and controlling production.

Not only that, but in order to consolidate the price of natural diamonds, De Beers spent heavily on advertising, gradually increasing from $20 a year to $10 million, followed by a growing number of diamond jewellery brands that followed suit with the "diamonds" and "love" association. The "diamond" and "love" connection. Through marketing, diamonds were successfully tied to love, encouraging women to see them as a necessity for romantic courtship, and that the bigger the diamond, the better the love. The Generation Z demographic, born in the late 20th century in particular, has been brought up with the idea that love and diamonds are already equated.

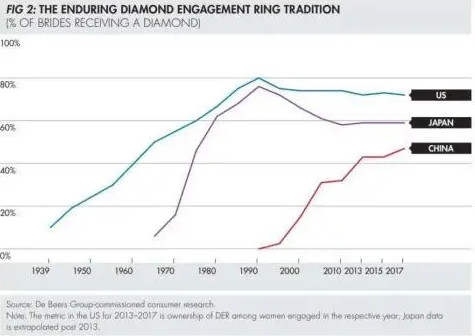

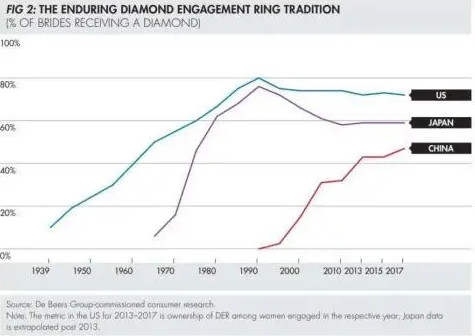

Through the same marketing techniques, natural diamonds have managed to penetrate major consumer countries such as the United States, Japan and then China. This is why, today, diamonds are used worldwide as the first choice for wedding rings. From De beers' consumer research, the percentage of diamond rings used for engagement in the US is 75%, in Japan it is around 60%, and half of all brides in China are using diamond rings, which is likely to amplify further in the future.

Diamond wedding ring penetration performance in the US, Japan and China

From: De Beers Consumer Research

Today's natural diamond rings have become a high-priced and in-demand luxury item that is "under the radar".

Consumers who buy natural diamond rings do so because they are a 'luxury' in their own right, in a way that fits the 'Van Buren effect': the extent to which consumer demand for a good is increased by its higher rather than lower price tag. It reflects the psychological desire of people to consume extravagantly. The higher the price of a good, the more desirable it is to consumers.

At the same time, natural diamond rings have the low-frequency but immediate need of "once in a lifetime" consumption (ideally), with a profound meaning of "LOVE" behind it (the need for love) and even "social "It is the "emotional" demand that dominates its purchase and makes people more willing to pay a premium for it. A man who had just bought a diamond ring mentioned: "We guys know it's carbon and it's not worth much, but even if it's an IQ tax, I'll accept it, because for girls, a natural diamond ring represents unique and loyal love, even if it's smaller, I naturally want to buy it".

The positioning of natural diamond rings and their attributes are not destroyed by the entry of HTHP diamonds; they are, to some extent, two product characteristics. Moreover, the price of a natural diamond ring is determined by supply and demand (behind which is capital control of production).

Natural diamond mining has always been highly monopolised worldwide, with mining resources concentrated in the hands of a few major miners. Both ALROSA and De Beers have accounted for no less than 55% of global sales of rough natural diamonds since 2015. These giants maintain global prices by organising the supply of diamonds through centralised sales, and have been successful in stabilising natural diamond prices in times of recession and inflation. Capital is not stupid and will not allow natural diamonds to collapse.

And if natural diamonds are no longer worth anything, then lab diamonds will be even less valuable, as they have added value by being linked to the "natural diamond's flat replacement".

Will it replace natural diamonds in the future?

A number of research studies have indicated that the declining production of natural diamonds has given the market for Loose Cvd diamond room to accelerate and, in the future, will replace some of the natural diamond market.

According to the "2020 Diamond Industry Insight Report" released by De Beers, some of the world's large natural diamond mines due to their service life or face closure. The Argyle mine, which produces 13 million carats a year and accounts for 9% of De Beers' rough natural diamond production, has announced its permanent closure in 2020, the Komsomolskaya mine, owned by Erosa, is close to shutting down and will do so in 2021, and the Diavik mine, owned by Rio Tinto, will shut down in 2025. New and expanded projects around the world will not be able to compensate for the decline in diamond production due to mine closures, and natural diamond production will remain under pressure for some time to come.

According to Frost Sullivan, the global supply of natural diamonds in a neutral scenario will only be 84 million carats by 2030, leaving the diamond market with a supply-demand gap of 159 million carats, and the cultivation of diamonds appears to be effective in easing the long-term supply pressure on natural diamonds.

Therefore, looking a little further out (forecast to 2030), the ability of the giants to explore for new natural diamond mines will be key. Until then, however, lab diamonds are a more difficult alternative to natural diamonds when natural diamonds are in plentiful supply.

Although lab diamonds look just like natural diamond rings and are cheaper than natural diamonds, they can to some extent be described as two categories, which are positioned differently. Behind the luxury positioning of natural diamonds is bound up with deep-rooted perceptions (diamonds = love) and their own natural, rare attributes, while in contrast, lab diamonds are mass-producible + no story = low value.

"Customers who come to buy a diamond ring still care about the symbolic meaning of the diamond itself, and with the current abundant supply of natural diamonds, we would not consider using Cvd Loose diamond." Andy, head of a couture diamond ring shop in Shanghai, said.

At this stage, those who were previously inclined to buy natural diamond rings are more likely to still do so, while those who turn to lab diamonds are in the minority. By widening the price band and allowing more of the original 'non-diamond' users to enter, the cultivation ring will complement the natural diamond ring and expand the diamond industry as a whole, which is its more important significance at the moment.

Also, please don't underestimate the power of capital.

Currently, De Beers is actually launching its own brand of synthetic diamonds, LightBox, in 2018, priced at $800 per carat, an eighth of the price of a natural diamond. But this is really just a strategy by De Beers to differentiate between natural and man-made diamonds and to instil a new concept: natural diamonds still represent eternity and true love and are rare, while man-made diamonds are suitable for everyday wear, thus differentiating the positioning of natural and man-made diamonds and intended to expand the diamond consumption scene.

At the same time, giants such as De Beers are no soft touch, they have stepped up their efforts to survey new mines and spend a lot of R&D costs each year to break through the exploration technology, and there are the same unknowns and variables for potential natural diamond production in the future.

What are the directions and difficulties in nurturing diamond development?

In fact, lab diamonds are still on the drawing board when it comes to questions such as "can they replace natural diamonds" and "how many natural diamonds can they replace". From the current perspective, there are two possible directions for the development of lab diamonds on the market, but there are many obstacles.

The first idea is to go for a lighter touch, by "customising" lab diamonds to enhance the sense of value, with the intention of capturing a small portion of the natural diamond market.

Today, many young people, such as Generation Z, prefer products that are differentiated and personalised, and so do diamonds. However, the problem is that it is clearly a light luxury product, but it is mass-produced, not only does it lack a sense of scarcity, but the "artificial cultivation" gives people a cheap feeling of "fake diamonds", with no story behind it to tell. There is no story behind it, and it simply cannot justify the price and value, so there is no good reason for consumers to buy it.

At present, lab diamonds are seen by more Chinese people as artificial, second-hand or imitation, so on the one hand, brands need to make an effort in "consumer education" to establish the concept of "real" diamonds. In fact, in terms of gross profit, the sales side of cultivating diamonds is more dynamic. According to data from the Foresight Industry Research Institute, the gross profit margin of lab diamonds is 60%, 10% and 60% respectively, while the gross profit margin of natural diamonds is 20%, 2.5% and 9% respectively.

However, there are currently fewer diamond brands cultivated and they are all mainly online. For categories such as diamonds, which need to be tried on in person, there is a need to lay enough offline shops to engage with a wide range of consumers in the future. By showing consumers the characteristics of both cultivated and natural diamond jewellery in shops, a consensus can be reached that lab diamonds are "real diamonds", but this will take a long time.

On the other hand, there is also a need for innovation in brand marketing. In the early stages of development, brands need to build not only the story of the brand, but also the connotation of the 'cultivated diamond' category. Natural diamonds, for example, have the value of love behind them, but what is the intrinsic value of lab diamonds? Similar to how Oatly made oat milk come out of the circle, relying on the combination of coffee + oat milk to raise category awareness and value, lab diamonds need such a strategy to raise value to convince consumers to enter such a category. For example, it may be possible to give lab diamonds a new meaning by allowing consumers to participate in a game of cultivated diamond making, designing their own finished products and ultimately customising the jewellery to reflect the 'uniqueness' of each cultivated diamond.

The second is the idea of opening up the mass market, and the cost effectiveness of lab diamonds, and their colourfulness (which can be customised through colour-changing technology), could be a fashionable route to capture more of the gemstone jewellery market.

But there are also two big problems. From the point of view of consumer habits, most diamond rings are also mostly used for wedding, a few are used for jewelry, and more importantly, the current lab diamonds, although compared to the natural diamond price is a lot lower, the price is still not competitive enough to do a real popular.

It is understood that the market "cultivated diamond price is a third of the natural diamond" slogan is limited to loose diamonds, if the design costs and brand value added into account, the price is not more than that. To "small white light" main 19,999 yuan 1 carat of loose diamonds, for example, plus the ring and design, the price can also reach 30-50,000. Such prices are not very attractive to consumers, whether as a wedding ring or a fashion item.

This is mainly determined by the fact that upstream technology is not yet mature enough and costs are high. Currently, the industry threshold for cultivating diamonds is high, with over a million dollars for just one instrument used to cultivate diamonds. Unless further breakthroughs can be made to drive the price down further, it is not competitive with other gemstone jewellery.

Currently, China produces more than 40% of the world's lab diamonds, of which 70-80% end up in the US market, while cultivated diamond consumption in China has only just begun. 2020 has seen the opening of offline shops by foreign brand Diamond Foundry and domestic brand Light Mark respectively, and lab diamonds are beginning to enter the lives of Chinese consumers.

However, at this stage, lab diamonds have a series of problems including a weak sense of category value, immature upstream technology and high costs, not only that, but the power of capital is even more powerful, with an invisible hand at play. There are also many variables in the future development of lab diamonds.

English

English 简体中文

简体中文